Mining assets are very challenging to value. The best way to value a mining asset or company is to build a discounted cash flow (DCF) model that takes into account a mining plan produced in a technical report (like a Feasibility Study mentioning the probable and possible mining reserves). Without such a study available, one has to resort to more crude metrics like Price to Net Asset Value, Price to Cash Flow, EV/Resource.

RBSA has carried out Valuation, Due Diligence and Financial Analysis of Mines and deposits representing more than 90% Copper Reserves, more than 90% of Zinc Reserves and over 85% of Lead Reserves of India.

RBSA has special expertise in

Valuation of Mines and

Minerals Reserves

Fully developed and

operational mines

Partly explored deposits and

exploration properties

Major and minor minerals,

metallic (Ferrous & Non Ferrous) and

non-metallic minerals,

fuel minerals

Open pit as well as

underground mines

Due Diligence, Mines

Valuation, Mineral Reserve

Valuation and Advisory

Mining Feasibility Studies

Mineral Reserve

Certifications

Review of Operations

and Mining Leases

Technical Opinions

Assessment of cost incurred for de-allocated mines

Team

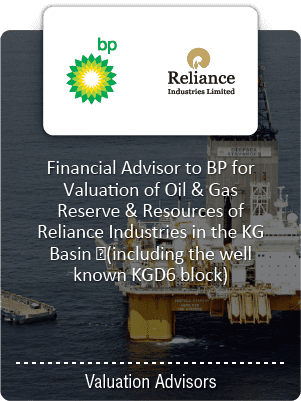

Credentials

Subscribe

to our newsletters & stay updated with the latest on RBSA