RBSA actively assists the COC/RP in managing the entire CIRP process effectively including preparation of Information Memorandum, RFRP and Evaluation Matrix keeping in view the specific requirements of the corporate debtor. RBSA adds its value particularly in the area of bringing in resolution applicants who are serious players- strategic as well as financial. This helps not only in early resolution of corporate debtors but also value maximisation for the stakeholders.

Transaction Advisory services

RBSA Restructuring team, works closely with our Investment Banking team members, has been connecting with several investors – strategic and special situation financers, and debt providers while working towards a resolution. In this connection, whether it is within CIRP or outside of CIRP, RBSA Restructuring, and Investment Banking teams have been successfully able to reach out to financiers – both within India and internationally in key investor and capital provider markets.

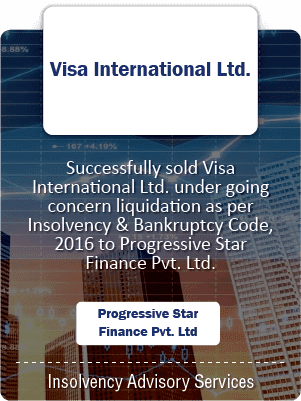

Credentials

Subscribe

to our newsletters & stay updated with the latest on RBSA