Every specialization meets its match at RBSA.

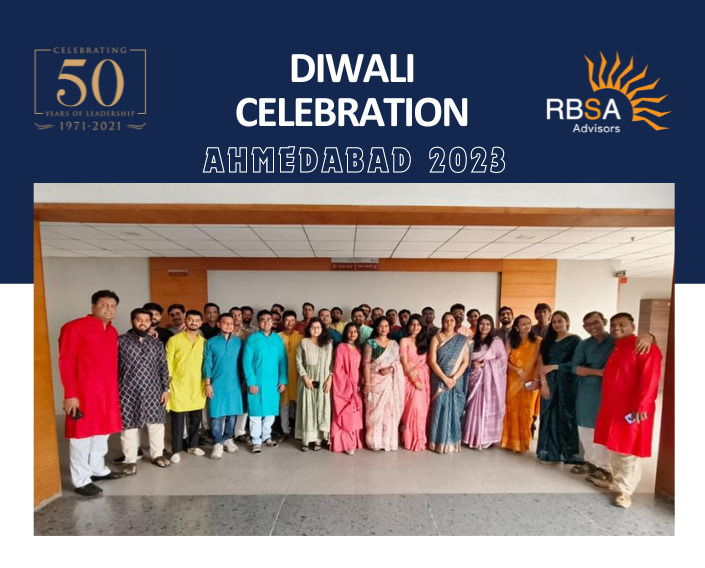

A great workplace thrives on culture, ideas and opportunity. You will find these at RBSA. Old school experience & wisdom with millennial/Gen Z exuberance, RBSA family strikes the perfect balance with vintage & digital natives leaning from each other.

We are not just a Transaction Advisory/Consulting firm full of people, we are a people firm being consulted for financial transactions.

If Transaction Advisory/Consulting is your career calling on the aforementioned platform, kindly email your resume on [email protected]

Current Openings

1.

Location:

Mumbai

1-3 years post qualification experience

CA / CA+ CFA (USA)

- Knowledge/ Understanding of various financial reporting standards such as Indian GAAP, IndAS, IFRS etc;

- Knowledge in financial valuation & financial modelling , business planning and Performing valuation analysis on a wide range of public and private entities using all accepted and relevant approaches and theory;

- Knowledge of providing Valuation services across sectors including real estate, hospitality, infrastructure, automotive components, manufacturing etc. (depends on the project);

- Knowledge about valuation of businesses to facilitate strategic decision making by clients, valuation of intangible assets like brands, patents, customer relationships, valuation of Derivatives and valuation for reporting and regulatory purposes (including purchase price allocations etc.);

- Designing financial models for discounted cash flow, market multiple, intangible assets;

- Actively involved in conducting feasibility studies and preparing business plans for various clients;

- Should have the fair value of share (using average of Net Asset Value, Profit Earning Capacity Value & Discounted Cash Flow Value) and Exchange Ratio in case of Mergers/Acquisitions;

- Use current technology and tools to enhance the effectiveness of services provided (including MS office – Power point, Excel, Word, Databases such as CapIq, Capitaline, Bloomberg etc.);

- Excellent communication, writing and presentation skills

1.

Location:

Industry:

Gurugram

Consulting Services

10-14 years’ experience (working with domestic clients post qualification)

CA / MBA (Finance)

- Practice development and management of a large team and set of elite clientele;

- Lead large scale engagements and deliver high-quality client solutions;

- Develop and Maintain strategic relationships with CXOs of different sectors and their leadership team;

- Lead proposals and create tailored offerings;

- Drive the identification and generation of business opportunities for RBSA with ability to generate sizable new Risk Advisory Services business. Or the incumbent should have existing relationships/ business to be developed in structured manner in the next few years;

- Create practical and innovative insights for clients, contributing to RBSA thought leadership;

- Leads the identification, communication, measurement, and management of company-wide risk;

- Depth of experience in consulting with clients on enhancing risk appetites, risk identification, modelling and managing specific risks;

- Experience in governance and risk management, program, project and change management, service delivery, strategic decision making, executive reporting and monitoring;

- Strong written and verbal communication skills for report writing, industry studies and client presentations;

- Successful business development skills in shaping and winning client proposals and generating sales;

- Innovative, solution oriented with the ability to understand a problem and tailor a practical resolution;

- Inspiring and authentic leader who supports their team’s career development.

Location:

Industry:

Consulting Services/ Investment Banking Boutique

2 to 5 years experience (working with domestic clients post qualification)

CA / CFA (USA) / MBA (Finance)

- Preparation of deal books and financial models;

- Carrying out financial analysis and valuation;

- Carrying out research related work on the transaction including data mining from sources such as Capital IQ;;

- Establishing and managing client data rooms for finance and tax due diligence processes

- Establishing credibility with clients as a representative of RBSA Advisors;

- You will closely work with clients through the course of the transactions and it is our expectation that associates will make a positive commitment to maintaining contact and relationships with clients.

Location:

Mumbai

4-6 years

CA

- Review of financial statements, conducting analysis of financial statements for preparation of pitch presentations, tax due diligence reports, and other client deliverables;

- Review of entire set of income-tax returns, tax assessment orders, tax computations and other information for identifying tax issues impacting the transaction;

- Basis the tax issues identified, preparing detailed tax diligence report summarizing the identified tax issues along with potential tax exposures;

- Be part of investor meetings to address queries pertaining to tax due diligence report;

- Carrying out research on issues relating to Income-tax Act, Companies Act, 2013, Foreign Exchange Management Act (FEMA) and Stamp Duty;

- Provide assistance in preparation of tax structuring presentations along with detailed implications of the identified options;

- Provide assistance in business development initiatives such as identifying potential targets, downloading financials from company website, preparing data books covering important financial information along with preparation of pitch presentations;

- Managing and coordination work with target and client;

- Giving inputs for matters that should be included in transaction documents for fair and indisputable conclusion of transaction.

Location:

Director/ Associate Director

- Serve as the key member for RBSA office in KSA covering Financial Advisory Services (“FAS”) that

include business valuations, business plans, business projections for mandates and projects for

clients in MEA region particularly in KSA. - Primary responsibility is to carry out business development, execution, and closure of all FAS

mandates in MEA working closely with MEA team and FAS team in India. - Secondary responsibility is to participate in coverage (business development, execution, and

closure) of projects, mandates, leads and prospects for other services lines including investment

banking, financial due-diligence, transaction tax, restructuring and risk advisory services working

in conjunction with respective service line leads and India teams for these service lines

- Strong FAS, Transaction Advisory experience in GCC, particularly in KSA for the last 5-7 years

with strong connects with government, private sector corporates, banks, and other entities - Excellent communication, writing and presentation skills.

- At least 12 years of business valuation and financial modelling experience. The person should

have worked on complex company forecast and valuation models. Experience in other corporate

finance is an advantage although not mandatory

Apply Now

Life At RBSA

We provide the learning platform along with an all-encompassing culture guiding you to become the best version of yourself enabling you to become a future leader and passing on the torch.

Our Ethos

Ethics & value system precedes all, do the right things the right way, seek data and build knowledge, everything else will fall in place.

Subscribe

to our newsletters & stay updated with the latest on RBSA