GCC Financial Sponsors – “The Capital Power House” GCC, formed in 1981,...

Read MoreOur Journey

The Journey of RBSA Advisors commenced in 1971.

In March 2021, we celebrated our Golden Jubilee.

The Journey of RBSA Advisors commenced in 1971.

In March 2021, we celebrated our Golden Jubilee.

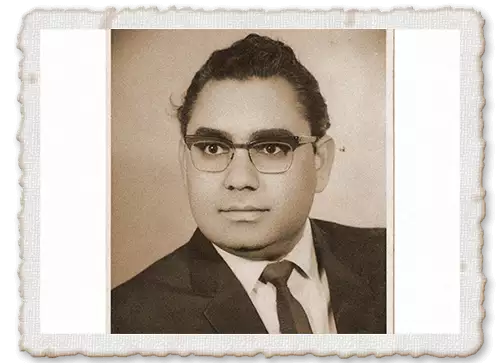

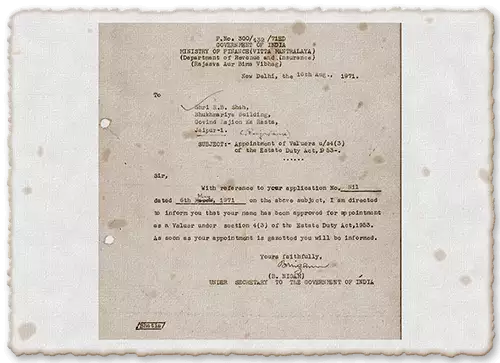

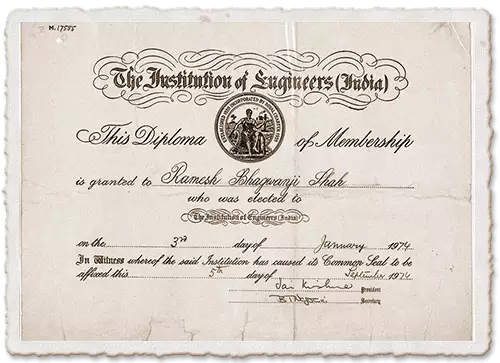

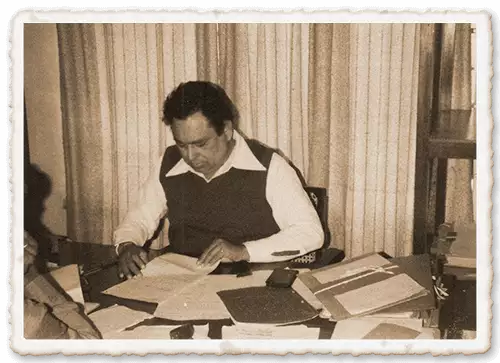

The enduring story of RBSA Advisors, as it is known today, began in 1971 with Mr. Ramesh B. Shah, our Founder Chairman & Mentor, in then a princely but dusty small town, Jaipur. Mr. Shah still continues to remain our Chairman and Mentor.

Read moreMr. Shah’s practice had taken roots now. These were the years of consolidation and experimentation. Mr. Shah hired a few staff and associates. As his reputation grew, he became a Valuer of choice for many Banks & Institutions.

Read moreMr. Shah’s prestige and reputation as an eminent Valuation professional grew. He was sought as a valuer of choice in Jaipur and Rajasthan. The practice was growing – not just in the State but across the Region.

Read moreR. B. Shah & Associates was looking at new opportunities now. This was a period of Economic Reforms in India wherein the Government of India was focused on Disinvestment of the Public Sector Undertakings.

Read moreOver next few years RBSA built great relationships with large publicly listed Companies, Banks and Financial Institutions. It became a full-service Valuation firm covering all asset classes. The firm grew exponentially in a short period of time.

Read moreRBSA’s name was now synonymous with high quality Valuation services in India. The firm grew into a team of 100 strong team members across India in 2012.

Read moreThis was a period of a Distress Asset and Nonperforming asset clean-up cycle in the Banking system. RBSA emerged as a key player in the Valuation & Financial Advisory services catering to Distress Assets.

Read moreToday, RBSA Advisors is a leading independent fully integrated and high-end Transaction Advisory firm with service offerings including Valuation, Investment Banking, Restructuring

Read moreRBSA Advisors is a leading independent Transaction Advisory firm with service offerings including Valuation, Investment Banking, Restructuring, Transaction Services, Transaction Tax, Risk Advisory and Litigation Support services.

Internationally recognized & reputed brand with a leadership position in Valuation Advisory.

A SEBI Registered Category I Merchant Bank focused on fund raising, M&A & Fairness Opinion.

Insolvency, Restructuring & Turnaround practice dedicated to both IBC & Outside IBC resolutions.

Financial Due Diligence Advisory for both investment and divestment initiatives.

Transactions Tax Advisory for M&A, PE Deals, Distress Debt Resolution & Succession Planning

Assessment of Credit Risk associated with Corporate borrowers on behalf of banks/institutions

Valuation & assessment of Damages in dispute, arbitration, and litigation situations.

RBSA Advisor’s Team of Technical Experts publish research reports, create analytical tools and other content to help our clients review the emerging trends, regulations, competition and other factors pertinent to their industries.

GCC Financial Sponsors – “The Capital Power House” GCC, formed in 1981,...

Read MoreDeep dive into Evolution and Impact of Artificial Intelligence

Industrial Revolution 5.0 : Deep dive into Evolution and Impact of Artificial...

Read MorePharmaceuticals Industry in India The Indian economy is projected to overtake both...

Read MoreRBSA Advisor’s views & opinions are followed and captured across spectrum of media.

We have worked with Clients across more than 30 Countries. We have trusted affiliates across USA, UK, Canada, Europe, Australia, China, Africa and Brazil.

Valuation Research Group (VRG) provides quality valuations and value-related services for the international business community, serving clients in more than 60 countries. Multinational engagements are managed locally by a single point-of-contact and executed by professionals located in respective countries. It has dozens of offices throughout continental Europe and the United Kingdom, as well as many throughout Brazil, China, Mexico, Canada, Argentina, Australia and the United States.

to our newsletters & stay updated with the latest on RBSA